Adyen is an enterprise solution for handling transactions. In the following Adyen review, we will take a look into its features, pricing, and what makes it different in helping you decide if this software is right for your company.

What Is Adyen and Its Features

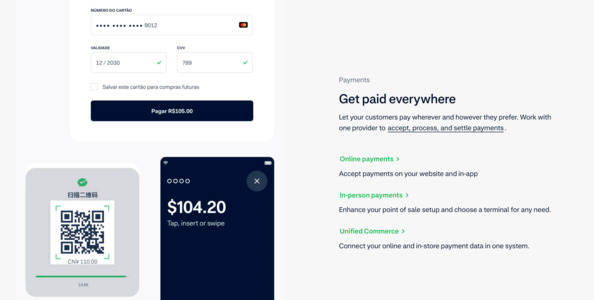

Adyen is an international payment platform enabling business owners to accept any type of payment, both online and offline.

Among its major features are:

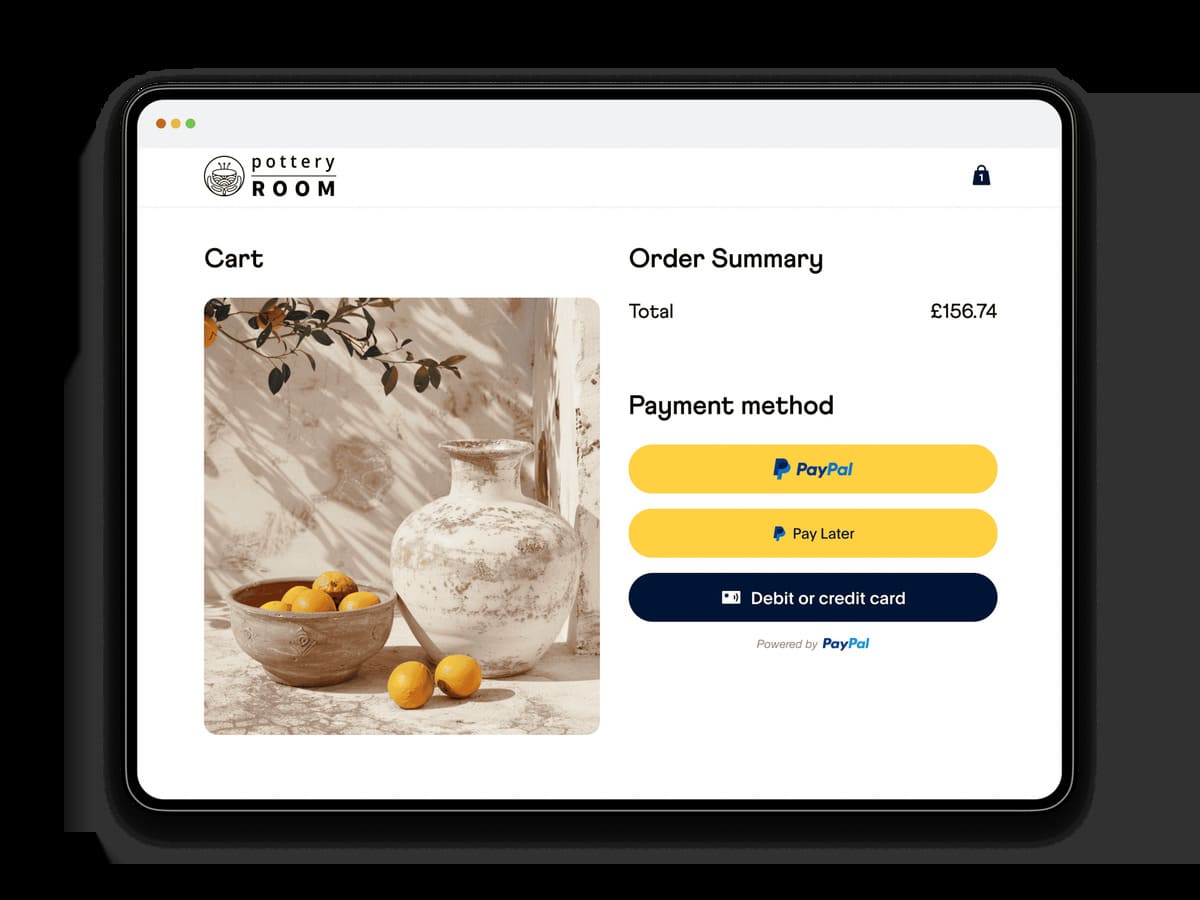

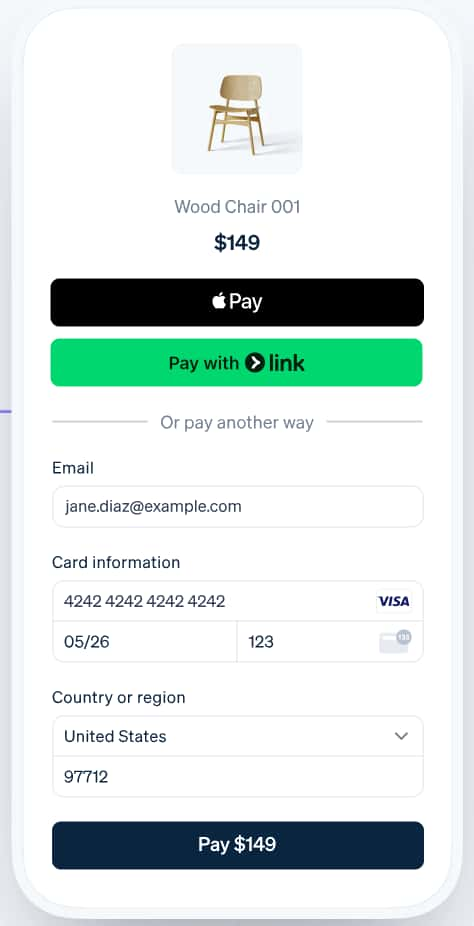

Multi-channel payment processing: Adyen supports a variety of payment methods, ranging from credit cards and digital wallets to local payment options, versatile for businesses operating in various markets.

Integrated Solutions: Businesses can manage all their transactions through a single platform, simplifying the payment process and enhancing operational efficiency.

Advanced Security Features: The company utilizes robust fraud prevention tools and encryption technologies to protect sensitive customer information.

Real-Time Data Insights: Through detailed reporting and analytics, one can efficiently follow up on transaction performance and customers' behavior.

Adyen Pricing

Adyen pricing is presented to be transparent and competitive. Key aspects include the following:

Transaction Fees: Adyen charges a fixed per-transaction processing fee in addition to a variable fee depending on the means of payment. There is usually, for instance, a € 0.11 fee along with an interchange fee regarding card transactions.

No Monthly or Setup Fees: There are no hidden fees, such as monthly or setup charges, which should make it fairly affordable regardless of business size.

Minimum Invoice Requirement: Depending on the business model, there is a minimum invoice threshold based on industry.

Adyen History

Adyen was founded in 2006 and grew rapidly by focusing on offering a unified payment experience. Major milestones include:

Going Global: Though the business initially launched in Europe, to date it has expanded worldwide, supporting more than 250 payment methods in more than 150 currencies.

Listing: In the year 2018, Adyen went public at the Amsterdam Stock Exchange to further seal its place among the greats in Fintech.

Summary

This review of Adyen makes the payment processing solution all about flexibility and transparency in one go. While the complex pricing may be weighing for high-volume merchants, features and security on the platform make it one of the best choices for businesses trying to streamline their processes related to payments.

If you need a reliable partner to take care of your payments, you might want to take a look at what Adyen offers.

| Pros | Cons | Unique Features | Pricing | Social Media |

|---|---|---|---|---|

|

|

|

|

|