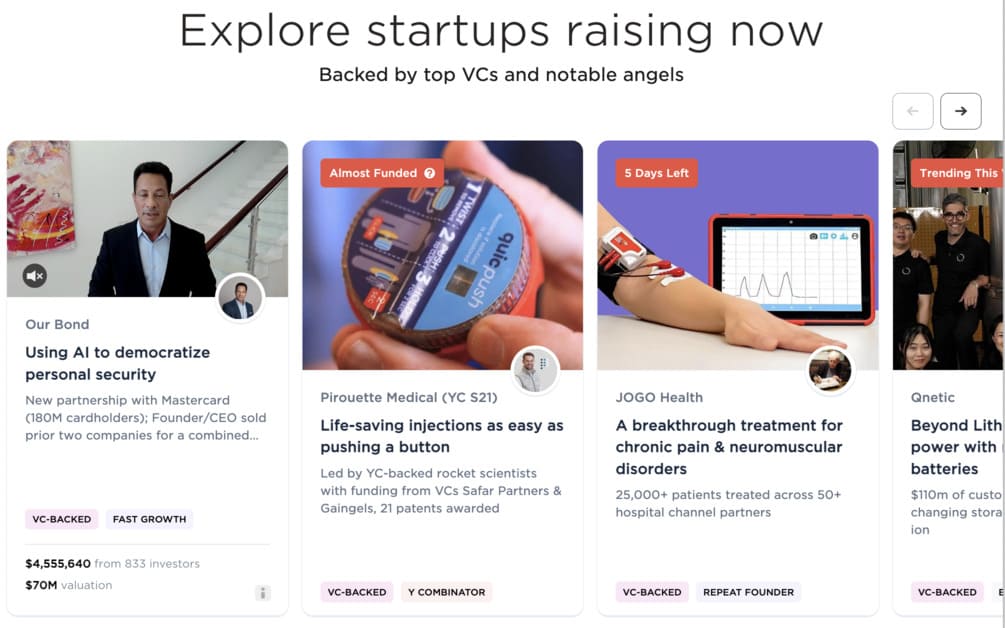

WeFunder is democratizing startup investing, allowing anyone to become an angel investor for as little as $100. This equity crowdfunding platform has mobilized $617 million in investments across 2,833 founders, creating over 38,000 jobs and $5 billion in follow-on financing.

What Does WeFunder Do

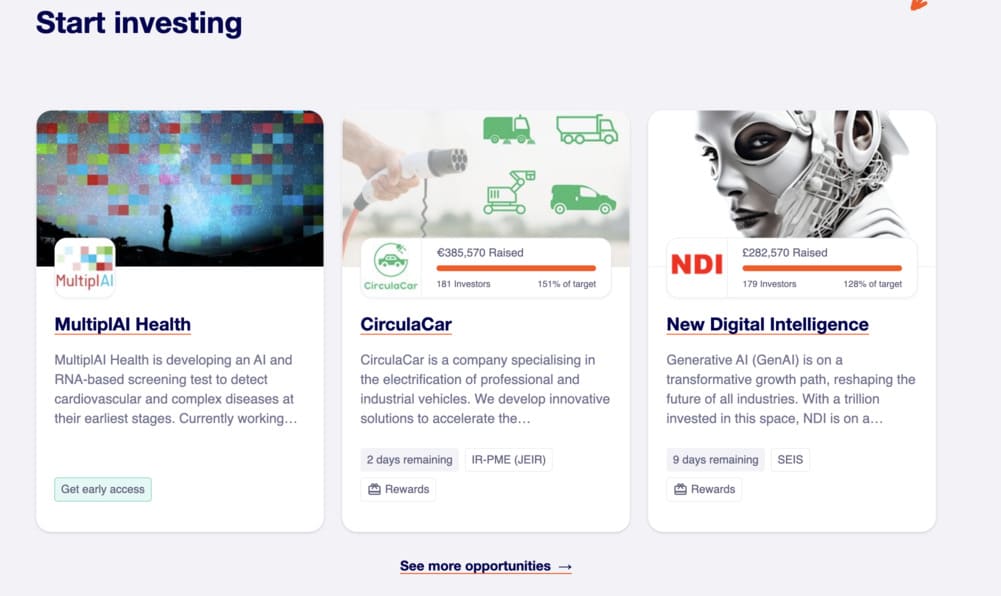

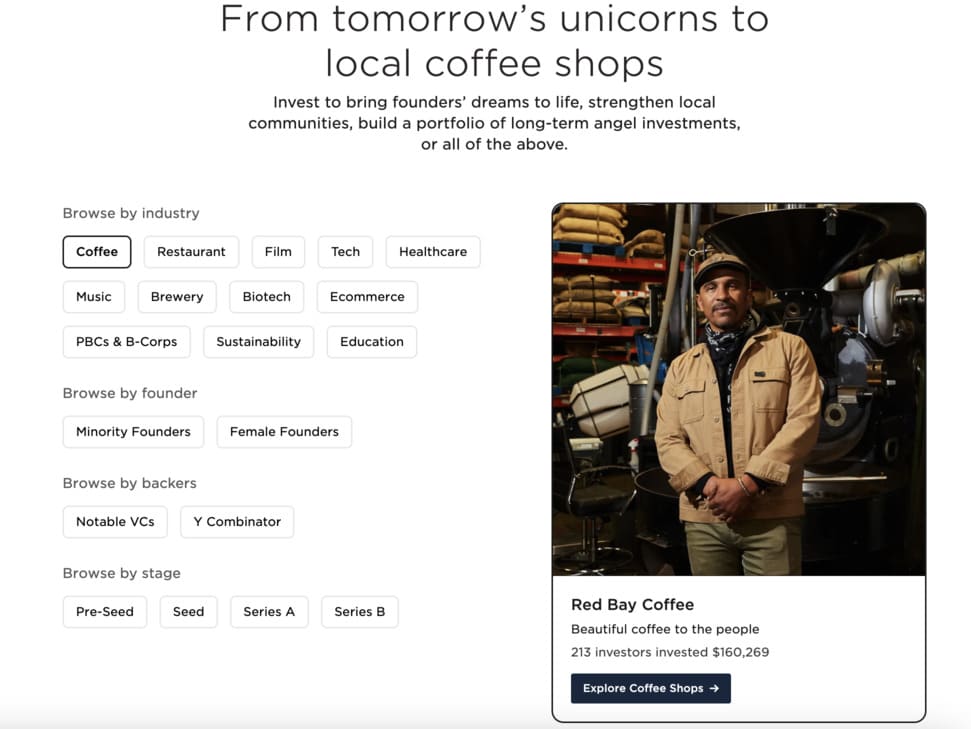

Think of WeFunder as the bridge between Main Street investors and the next great startups. On WeFunder, invest in anything from craft breweries and coffee shops to tech and medical startups. WeFunder is a Public Benefit Corporation and certified B Corp, meaning its mission extends beyond profits to community and entrepreneur development.

Pricing

The pricing is pretty straightforward:

It's free to create a company profile on Wefunder.

For Reg CF, Wefunder charges only 7.9% of the total raise if successful. For instance, if a company raises $100,000, we charge $7,900 upon close. We charge no upfront fees. After the successful raise, a company can choose to file their annual report with us for $500.

Additionally, we charge an annual admin fee of $1,000 per year for all companies** to cover a variety of post-close services, including the following:

- Assisting with investor updates & communications

- Calculating and distributing payouts for debt raises

- Calculating and updating investor portfolios for equity raises

- Securely distributing tax documents to investors

- Filing taxes for investors in your SPV, if applicable

** For LLCs, the fee might be altered by certain tax circumstances. For more info on SPVs for LLCs and what that means for taxes, read the full explainer

Investment Choices

WeFunder indeed offers various investment contract options to achieve maximum investor flexibility. They are:

- SAFE (Simple Agreement for Future Equity): Grants investors the right to buy equity in the future, typically with valuation cap and no interest or maturity date.

- Convertible Notes: Unsecured convertible debt to stock in future rounds of financing, typically with valuation cap, discount rate, and maturity date.

- Preferred Stock: Capital at a predetermined price per share, utilized in priced rounds.

- Revenue Share Loans: Repayment promissory notes out of business revenues, suitable for companies that generate cash.

- Promissory Notes: Repayment schedule loans at fixed times, which are similar to the traditional loan.

All of these are validated by independent sources like Wefunder's own records and third-party feedback.

Summary

WeFunder offers the most approachable way of getting into startup investing, and one that is so well-suited for investing in local businesses and cool projects. It's phenomenal at user education, offering a comprehensive catalog of choices to invest in. However, the prudent course in this space remains one of patience and risk tolerance. Minimum investments of just $100 also make it particularly friendly for new entrants taking a first sip in the market of startup investment. However, success may demand patience coupled with due diligence.

| Pros | Cons | Unique Features | Pricing | Social Media |

|---|---|---|---|---|

|

|

|

|

|